Today's Top Highlights

sponsored news

News

‘He just had an aura’ - the cult of Asprilla

-

- By Angela Riley

- 18 Sep 2025

News

An Inspired Recipe for Lasagna with Courgette and A Trio of Cheeses

-

- By Angela Riley

- 18 Sep 2025

News

President Trump Applauds Jimmy Kimmel Suspension as TV Stations Replace Broadcast with Charlie Kirk Special

-

- By Angela Riley

- 18 Sep 2025

News

Clarks Launches an Museum to Commemorate Two Hundred Years

-

- By Angela Riley

- 18 Sep 2025

News

Black Rabbit Review: A Grim Drama That Struggles to Make Audiences Care

-

- By Angela Riley

- 18 Sep 2025

News

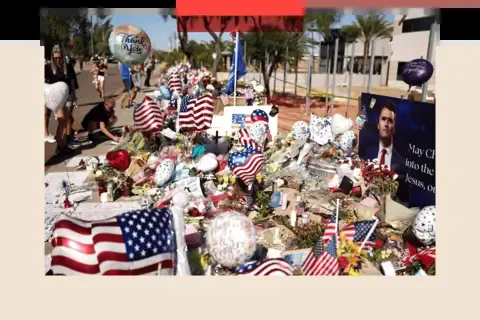

Why America Faces a Dangerous Crossroads Following the Charlie Kirk Assassination

-

- By Angela Riley

- 18 Sep 2025